Small business owners can utilize receivables, inventory, purchase orders and other collateral to unlock cash right away with asset based lending.

Compare the best approval options available in our 75+ lender marketplace and get accurate answers to your questions from one of National’s knowledgeable Business Financing Advisors. Banks have a long turnaround time and a complicated process, even while your asset will lower their risk. While rates may be slightly lower, you’ll pay for this in extended review processes and potentially lower financing amounts. If you’re not concerned about your opportunity fading away or your competition catching up, though, then this may be a good option.

What Is Asset Based Lending?

Asset based lending is a type of business financing in which the lender secures the agreement with an asset or collateral. Asset based lending can give the borrower either a loan or line of credit. Collateral for asset based lending doesn’t need to be real estate. Other more liquid assets, like receivables, inventory, purchase orders, and potentially equipment can also act as collateral. You can leverage one or more of these assets to secure a loan or an ongoing credit facility/line of credit for your business. Unlike other financing options, your business can qualify for asset based financing with a low credit score or no history. Rather than meeting traditional requirements, you can qualify based on your receivables, inventory, or other assets. Asset based lines of credit and loans help you capitalize on the value of your liquid assets right away. Instead of waiting for payments, you can get working capital to cover expenses like growth, expansion, additional inventory purchases, and more.

How Does Asset Based Lending Work?

Asset based lending works like most other business financing options—you get cash to drive your business growth and pay it back over time. Asset based lending, however, involves putting up an asset (which will be explained below) as collateral. You can choose to put up real estate, but there are many other options that may be simpler, easier, and less risky. It’s not uncommon for new and older businesses to experience cash flow issues due to rapid growth or slow-paying customers. In these situations, asset based lending helps you unlock instant cash to use immediately by leveraging assets like receivables, inventory, and more. Many businesses utilize asset based lending for standard working capital needs or shortages, during seasonal slow periods, and to cover slow-paying receivables. When you put an asset up as collateral, you’re reducing the lender’s risk and giving them confidence because they’re given a security interest in the asset. As a result, this may reduce your interest rate. However, interest rates can vary based on a number of factors. While there are a number of types of collateral, lenders tend to prefer highly liquid assets like receivables to illiquid options like equipment. Nonetheless, you can still find great options by putting up your equipment as collateral. Revolving asset based credit lines allow you to continuously draw additional capital as you need it.

Our Streamlined 75+ Lender Marketplace

How much extra cash could your assets unlock?

Find the best asset based lending options available through one simplified application. Understand your options based on the assets and collateral you’re willing to put up. Compare interest rates, term lengths, and funding amounts on National’s marketplace with expert guidance.

Apply in less than a minute. Hear your options explained right away.

Get funded in as little as a day.

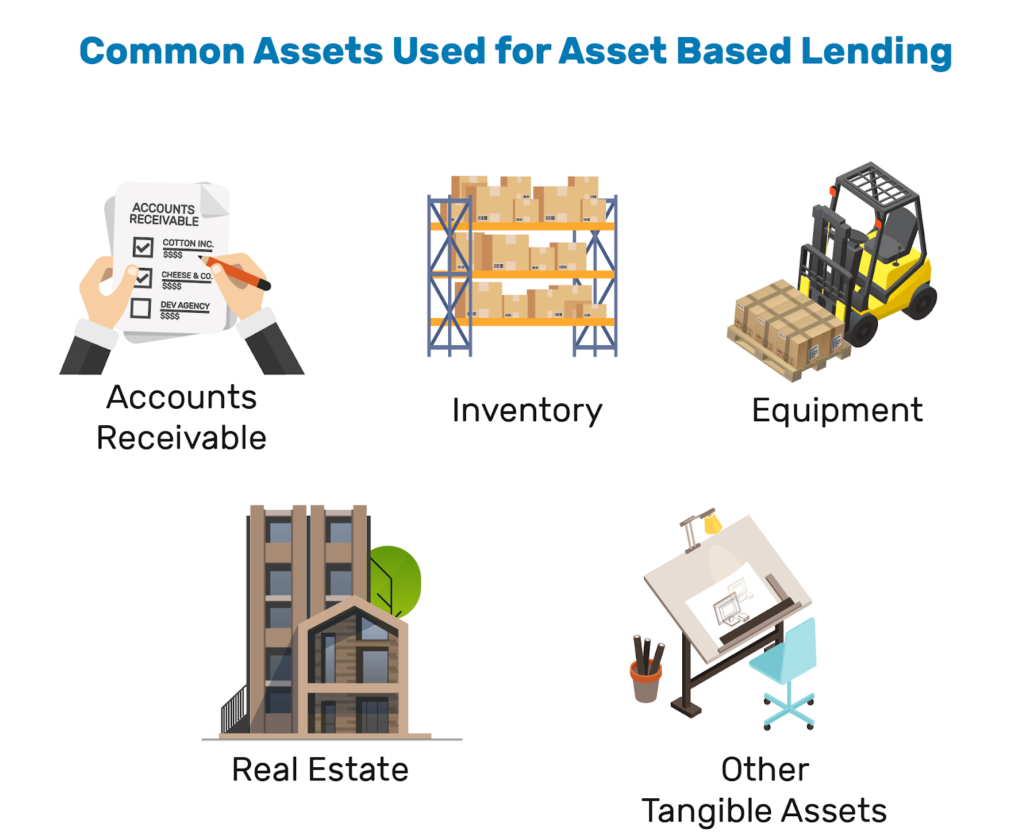

Types of Assets You Can Use as Collateral

Asset based lending relies on collateral, but that doesn’t mean you need physical collateral like land or real estate. In fact, there are several types of collateral you can utilize to secure term loans or lines of credit and raise the borrowing base. However, keep in mind that lenders will find some types of assets more valuable than others. Lenders tend to prefer assets with more liquidity because they provide added security with minimal risk. Nonetheless, you can generally utilize illiquid assets like land and real estate, especially if you’re looking to add security with other assets in the mix.

- Accounts Receivable or Invoices : Utilize unpaid invoices from late-paying customers to unlock new cash and invest in the future of your business.

- Inventory : Put up unsold inventory as collateral. While your inventory may be valued at wholesale, rather than market rates, you can still gain significant leverage.

- Purchase Orders : Instead of turning down future sales due to working capital shortages, sell future sales to receive cash for materials and capitalize on your opportunities.

- Equipment : Secure your financing with a hard asset, like collateral. The easier a lender can resell the equipment on the secondary market, the better your equipment will function as collateral.

- Real Estate : Real estate can add extra security for hard money lenders, but is best used in asset based lending when coupled with more liquid assets. It’s a great form of secondary collateral that you can use to qualify for additional financing, when receivables don’t cover exactly what you need.

Unsure of which collateral you can use to qualify for asset based lending? After applying, speak with your lender about the assets you have available and learn which would make the most sense based on your needs.

No Time In Business Requirement

Even as a young, growing business, you can still find financing options with the right assets.

$50K in Monthly Revenue

Most lenders will want to see at least $100,000 in monthly recurring receivables or purchase orders

No Minimum Credit Score

Asset based lenders don’t typically focus on credit score—you can find options with challenged credit.

Assets or Collateral

Typically, you can access 50-95% of your collateral, whether you utilize receivables, purchase orders, or another option

How to Use Asset Based Loans

When it comes to fast cash for urgent working capital needs, asset based lending is a simple, fast and easy option. Generally, there are no restrictions on how you can spend these funds.

- Fuel Business Growth: Take the next steps in growing and expanding your business by opening a new location, expanding offerings, and more

- Fund Inventory Purchases: Obtain inventory in bulk quantities to lower costs and drive profits, especially during peak periods

- Fill New Orders: Invest in growth by purchasing the materials you need to fill incoming orders, despite high upfront costs

- Cover Expenses: Stay on top of rising operating costs like rent, insurance and more with an asset based loan or credit line

- Keep Extra Cash on Hand: Never miss a new, revenue-generating opportunity again with extra cash in your back pocket

- Endure Slow Seasons: Cover expenses like payroll, operating costs, and marketing during slow seasons when revenue is down

You can put your additional working capital toward any expenses that will help your business grow!