The Hybridge® SBA Loan is a New Expedited SBA Process With Immediate Funding. The Fastest, Easiest SBA Process on the Market 90% Approval, Larger Offers, Prime Rate+, Longer Terms.

What Do You Need to Qualify?

2+ Years in Business

Hybridge® SBA Loans are available to all businesses that need funding to grow.

$120,000 in Annual Gross Sales

Whether you do $120K or $12 million in a year, we have your back!

685+ FICO

You don’t need perfect credit to qualify—just a score of 685+.

Apply Now

What is Hybridge® SBA Loan?

The Hybridge® SBA Loan was created from the demand of small business owners for a simpler, faster SBA process. If you want all the

great terms and low rates of an SBA loan, but you can’t wait to get funded, then the Hybridge® SBA Loan is the right choice for you.

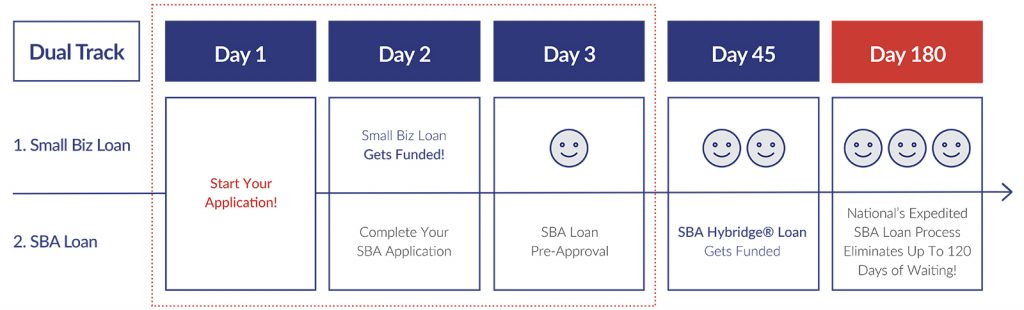

Your Funding Timeline With a Hybridge® SBA Loan

What Are The Benefits?

Immediate Bridge Capital

Get capital in as little as 24 hours to eliminate prolonged SBA wait times.

Quick, Streamlined SBA Process

Through an exclusive process, receive SBA financing in as little as 45 days.

Increased Approval Rates

Receive multiple offers through our exclusive global marketplace of 75+ lenders.

We’ve Secured Over $1 Billion in Funding Through Our Exclusive Marketplace

The Fastest & Easiest SBA Process on the Market

Why wait for working capital if you don’t have to? Learn how you can

access low SBA loan rates in just 45 days, and get immediate capital to bridge the gap!

Hybridge® SBA Loan | New SBA Program | No Wait

Apply Now

Unlock the Lowest Rates, Longest Terms and Highest Amounts

Loan Amount

$50,000 – $5Mil

Flexible Terms

10 – 25 Years

Time to Fund

1 – 3 Days

Apply Now

How Can You Use Your Hybridge® SBA Loan?

There are no restrictions—use your capital to pursue any opportunity or overcome any challenge!

Business Growth

Buy new equipment or inventory, hire new staff, or prepare for seasonal changes.

Business Expenses

Get extra working capital to manage payroll, bridge gaps in cash flow, or pay bills.

Business Opportunities

Expand or open a second location, take on more clients, or capitalize on bulk order discounts.