A Simple And Accurate Process – Using Licensed CPAs Working On Contingency to get employers the IRS Employee Retention Credit ( ERC ) 2022 of Up To $26,000 Per Employee.

Determine Your Eligibility Now

What is IRS Employee Retention Credit

The IRS Employee Retention Credit (ERC) is a Payroll Tax Credit ( ERTC )designed to reward businesses for retaining employees during COVID-19. The credit was initially signed into law March 2020 as part of the CARES Act. The credit was later expanded upon with the Consolidated Appropriations Act in December 2020 and the American Rescue Plan Act in June 2021.

Business Owners can receive a refundable credit up to $5,000 per employee in 2020, and $7,000 per employee, per quarter (excluding the 4th quarter), in 2021 for qualified wages. This can total up to $26,000 per employee.

Who Is Eligible To Claim An IRS Employee Retention Credit?

If You Had A Reduction In Revenue

Results in a credit per quarter affected

50% Reduction In 2020 – If there is a reduction in your gross receipts in 2020 when comparing to the same quarter in 2019 by at least 50%

and/or

20% Reduction in 2021 – If there is a reduction in your gross receipts in 2021 when comparing to the same quarter in 2019 by at least 20%

Or From The Recovery StartUp Program

If you started a business after February 15, 2020, and had annual gross sales receipts less than $1,000,000.

Or If Impacted By Government

Results in credit per date range selected

If a governmental order had more than a nominal impact on your business operations, such as:

- Required to fully or partially suspend operations tied to governmental orders.

- Inability to obtain critical goods or materials from suppliers because they were required to suspend operations due to governmental orders.

- Limiting occupancy to provide for social distancing due to governmental orders.

- Governmental orders to shelter in place preventing employees from going to work.

- Other similar impacts from government.

Find Out How Much You Qualify For

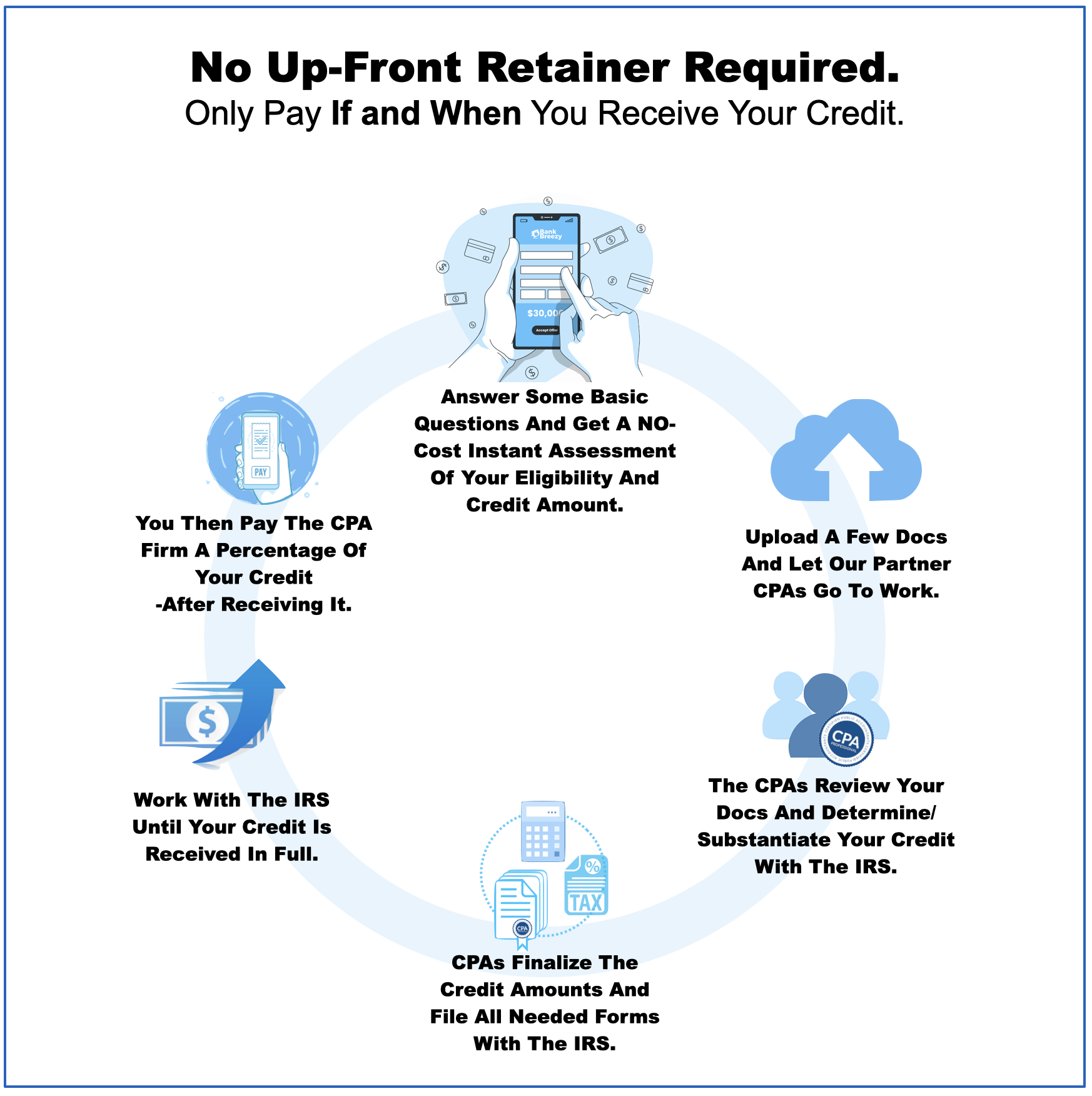

How Our Process Works

YOU WILL WORK DIRECTLY WITH OUR CPAS TO: