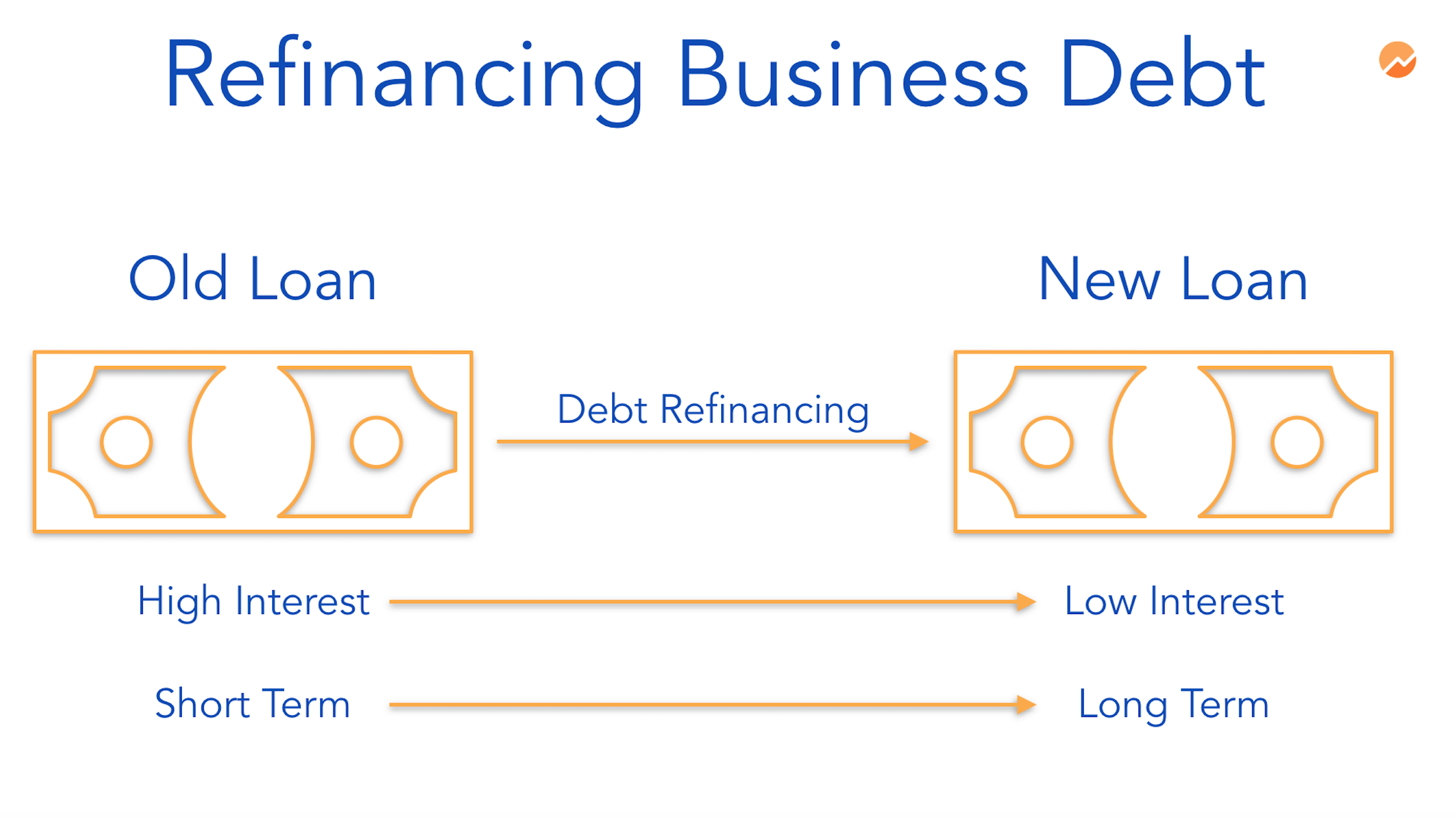

After paying down a business loan, you may be able to further reduce your debt. Refinance business loan to lower interest rates or extend repayment terms — or possibly both.

Refinancing your business loan involves applying for a new loan, either with the original lender or a different one. After repeating the loan process, you get a loan that pays off your existing debt.

There are several factors to consider before moving forward with a business loan refinance. Keep reading to understand what the process could entail and how your business could benefit.

Get Refinancing

Contact Us And Learn How To Get A Refinance Business Loan

Custom refinancing financing solutions for your small business.

We provide access to industry-leading SBA and alternative small business financing. We’re dedicated to matching entrepreneurs with lenders and loan products that provide real value at reasonable costs. It isn’t unusual for small business owners to be led astray by brokers or lenders who simply want to make more money off of each transaction, so we’ve stepped in to provide unbiased, completely tailored advisory services, combined with exceptional educational materials on small business finance. We aim to give entrepreneurs and business owners the confidence and knowledge they need to acquire the financing they deserve for their small business. While we specialize in SBA financing, our team has access to many alternatives when it comes to business financing sources, so rest assured that no matter what a borrower needs, we have them covered.

We are the connection between borrowers and lenders

Easy loan application

The Intelligent loan portal guides a borrower through a series of easy-to-answer questions about the prospective loan.

Organized documents

The integrated document hub allows for borrowers to easily upload and manage all supporting loan documents directly in the portal.

Stunning loan summary

Our software processes key elements of the application and instantly generates a beautiful loan summary.

Algorithmic borrower and lender matchmaking

Lender partners also utilize our portal to engage with matched borrowers. It’s like Tinder, but for commercial real estate & business finance!

We provide technology enhanced, frictionless access to refinance your business loan

You want the best terms on your business loans. You want the process to be easy. We seamlessly help to connect you to the right lenders making the process frictionless.

Meet the future of business refinancing.