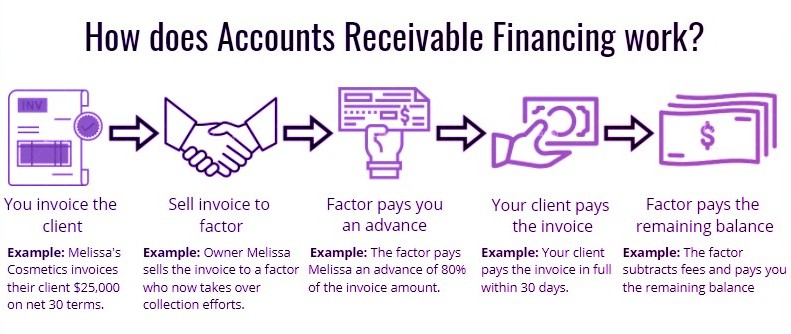

With accounts receivable financing, small business owners can structure an asset sale or loan agreement in order to receive an injection of capital correlating to a portion of its accounts receivable.

Outstanding invoices can be the bane of any business, but many small businesses simply do not have the capital reserved to persevere through these periods.

This allows businesses to stay ahead of the curve or avoid running into capital chokepoints by receiving early payment on outstanding invoices.

The invoices are typically put up or “committed” as collateral for the funding amount.