Discover How To Get Funding With Our Proven & Simple System and Fund Your Startup Or Small Business 0% Interest For The First 12 Months. HOW IT WORKS STEP 1 | APPLY Submit your credit […]

Why You Should Apply for a $50K Business Loan Today

Are you an aspiring entrepreneur, brimming with innovative ideas but lacking the necessary funds to kickstart your dreams? Fret not, for the world of a business loan is here to pave the path to your […]

Funding Group Solution To Start Up Or Grow Your Business

Secure the funding you need to start up or grow your business with help from our trusted team of Experts! Whether you’re looking to start a new business or looking to grow your business, a […]

Small Business Term Loan Apply Today & Get Funded Tomorrow!

Our Small Business Term Loan offers low rates and flexible terms, and does not require collateral. Apply Today & Get Funded Tomorrow! Some businesses have different needs, so they demand and deserve financing with longer/better terms. Maybe you’re looking […]

Small Business Loan vs. Business Line of Credit: Pros and Cons

A small business loan is best for major projects, while a business line of credit make sense for ongoing costs. Here are the pros and cons of each form of business financing. Business loans and […]

Small Business Owner Do You Ask Your Lender The Following Questions?

Before you apply for a small business loan, asking your potential lender a few simple questions can help make sure you get the loan, and lending experience, that best meets your needs. 1. What kind […]

The Best Small Business Loans – Get Funded Today

Grow Your Business or Overcome Any Challenge. The Best Small Business Loans – Get Funded Today. Give your business a boost. Take your business to the next level. Solve cash flow problems. Fast, easy and […]

Funding For All Business Types Simple and Fast

When your bank can’t help with funding – we can! Simply enter your business info and get your offer in no time flat. Loan Types: 1.Same Day Side-Gig Funding $500 – $5,000 $3K+ monthly gross […]

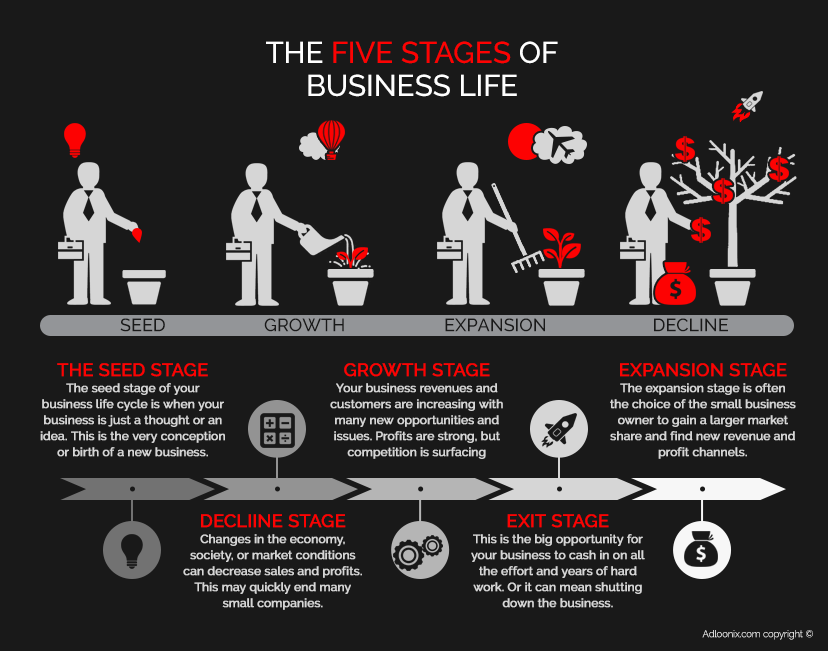

How You Can Get a 1 Million Small Business Loan?

Whether you’re looking to expand operations or take on a new direction entirely, a $1 million small business loan can help you jumpstart your next phase of growth. But before you can access funds, you’ll […]

Guide to Small Business Loans for Business Owners

When it comes to small business loans, you need the right solution. This guide helps business owners compare options available through a lender marketplace and a way to speak to a knowledgeable expert and ensure […]