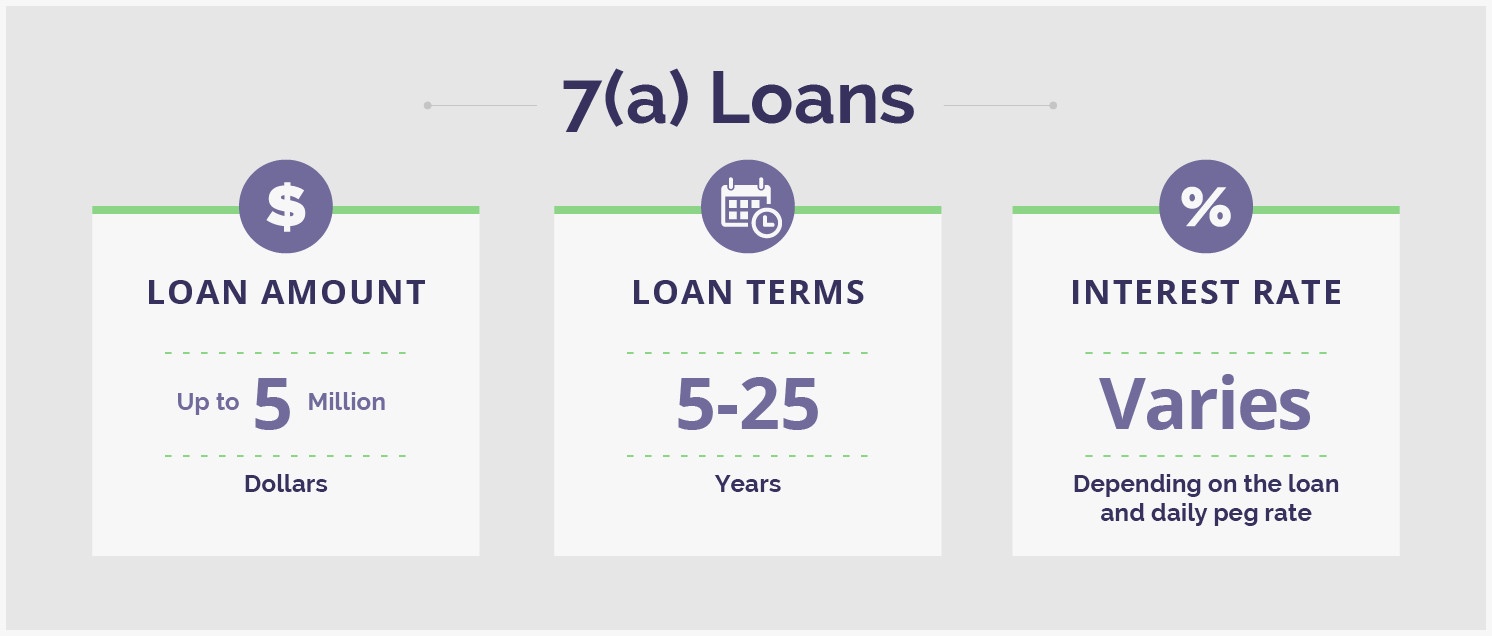

The SBA 7a Loan is the flagship loan product of the entire SBA financing umbrella for small business owners. SBA(7)(a) loans can be utilized for funding of up to $5 million and have a term length of up to 25 years depending on the loan purpose.

The funds can be used for working capital, equipment, buying a business or franchise, refinancing debt, and/or purchasing real estate.

Of course, your SBA lender will have their own criteria about how to use the proceeds from the SBA 7(a) loan you choose.

Different financial institutions may have more or less stringent requirements for how you can use the loan. That is why it is important to find an SBA lender who can provide an SBA (7)(a) loan that best suits the specific needs of your business.

Our partner experts are highly experienced in working with SBA lenders to match borrowers with the lenders and loan products that they need.