When it comes to starting or expanding a small business, one of the most common challenges entrepreneurs face is securing the necessary funds. In the world of business finance, there are various options available, but what is the most common form of financing for a small business?

Let’s delve into this question and explore the types of business loans that can help you take your business to the next level.

Types of Business Loans for Your Business

Small business loans are a cornerstone of financial support for budding entrepreneurs. These loans are specifically designed to provide capital for small business owners to cover a range of expenses, from launching a startup to managing day-to-day operations or expanding their enterprises.

Small business loans come in several forms, each tailored to meet different business needs. Here are some of the most common types:

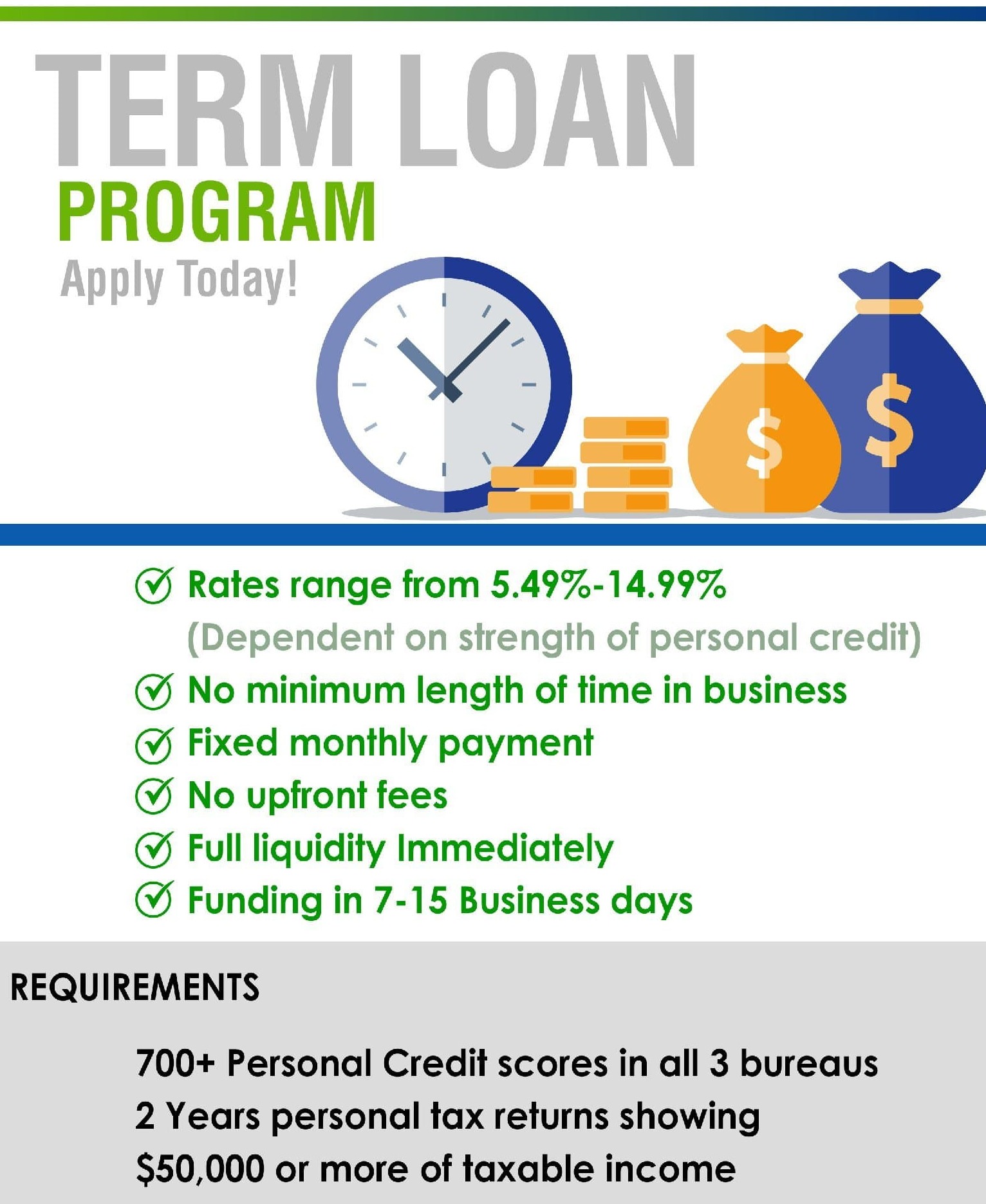

1. Term Loans

Term loans are perhaps the most traditional form of small business financing. They involve borrowing a lump sum of money, which is then repaid over a set period, often with fixed monthly payments. These loans are ideal for businesses with established credit histories and financial stability. They can be used for various purposes, such as purchasing equipment, expanding operations, or increasing working capital.

Pros:

- Predictable repayment structure.

- Lower interest rates for businesses with strong credit.

Cons:

- May require collateral or a personal guarantee.

- Not the best option for startups with no credit history.

2. Business Lines of Credit

Business lines of credit offer flexibility to business owners by providing access to a predetermined credit limit. Entrepreneurs can draw funds from this line as needed, and interest is typically charged only on the amount borrowed. This financing option is excellent for managing cash flow fluctuations, covering unexpected expenses, or taking advantage of growth opportunities.

Pros:

- Flexibility to borrow as needed.

- Pay interest only on the amount used.

Cons:

- May have higher interest rates than term loans.

- Requires a good credit score and business financials.

3. SBA Loans

The U.S. Small Business Administration (SBA) offers various loan programs designed to support small businesses. These loans are partially guaranteed by the SBA, which makes them more accessible to borrowers who may not qualify for conventional loans. SBA loans often have competitive interest rates and longer repayment terms.

Pros:

- Lower down payments and longer repayment terms.

- Competitive interest rates.

Cons:

- Strict eligibility criteria and paperwork requirements.

- Longer approval process.

4. Equipment Financing

For businesses that need to purchase or lease equipment, equipment financing can be an excellent choice. This type of loan allows you to acquire essential assets without depleting your working capital. The equipment itself often serves as collateral for the loan.

Pros:

- Specific to equipment purchases.

- Preserves working capital.

Cons:

- Limited to equipment-related expenses.

- Equipment may be used as collateral.

APPLY NOW

Comparing Small Business Loan Options (+ Their Pros & Cons)

Now that we’ve explored some of the common types of small business loans, let’s dive into comparing these options to help you make an informed decision.

Interest Rates

When comparing small business loan options, interest rates play a significant role in your decision-making process. Term loans and SBA loans generally offer lower interest rates, making them cost-effective choices. Business lines of credit, on the other hand, may have slightly higher rates, but you only pay interest on the amount you use.

Flexibility

If flexibility is a top priority for your business, a business line of credit may be your best bet. It allows you to borrow funds as needed, which is ideal for managing variable expenses or seizing unexpected opportunities. In contrast, term loans and equipment financing have fixed loan amounts and terms.

Eligibility

Eligibility criteria can vary widely among different types of business loans. SBA loans often have stringent requirements, including a detailed business plan and collateral. Business lines of credit may require a good credit score and a track record of financial stability. Term loans and equipment financing may be more accessible to newer businesses, provided they can meet the lender’s credit standards.

Repayment Terms

Repayment terms can significantly impact your cash flow. Term loans typically come with fixed monthly payments, which can help you budget effectively. SBA loans offer longer repayment terms, while equipment financing often aligns with the expected lifespan of the equipment being financed. Business lines of credit have flexible repayment schedules based on the amount borrowed.

Speed of Funding

If you need funds quickly, business lines of credit are known for their speedy approval and access to cash. Term loans and SBA loans may have longer approval processes due to the required documentation and underwriting. Equipment financing timelines depend on the purchase and financing arrangements.

How to Decide Which Small Business Loan Is Right for You

Choosing the right small business loan is a critical decision that can significantly impact the success of your venture. Here are some steps to help you make an informed choice:

1. Assess Your Needs

Start by carefully evaluating your business’s financial needs. Are you looking to cover day-to-day operating expenses and ensure a smooth cash flow? Or perhaps you’re planning to invest in new equipment to enhance productivity and stay ahead of the competition. Another possibility is funding a specific project, such as expanding into new markets or launching an innovative product. Taking the time to thoroughly understand your unique financial requirements will allow you to effectively narrow down your options and make informed decisions for the success of your business.

2. Consider Your Creditworthiness

Your creditworthiness holds significant importance when it comes to loan approval and the terms you’ll be offered. To assess your creditworthiness, it’s crucial to check both your personal and business credit scores and history. By having a strong credit profile, you’ll open up a world of financing options, giving you greater flexibility and opportunities to meet your financial needs. Remember, a robust credit foundation can pave the way for a brighter and more secure financial future.

3. Research Lenders

When exploring different lenders, take the time to consider a variety of options. These can include traditional banks, online lenders, and credit unions. Compare not only their loan products, interest rates, and terms, but also delve into their reputation and customer feedback. Look for lenders who have a proven track record of serving businesses similar to yours, as this can provide valuable insights and guidance for your own borrowing needs. By conducting thorough research and analysis, you can make a well-informed decision and find the best fit for your business.

4. Understand Costs

To make an informed decision about borrowing, it’s important to calculate the total cost of each loan option. This goes beyond just considering the interest rate and includes any additional fees like origination fees or annual maintenance fees. By carefully evaluating these costs, you can gain a better understanding of how they will impact your overall financial situation and make a choice that aligns with your bottom line. Taking the time to analyze these details will help ensure that you’re making the most cost-effective decision when it comes to borrowing.

5. Review Repayment Terms

When examining the repayment terms for each loan type, it is crucial to consider various factors. Take into account whether fixed monthly payments align with your cash flow, providing stability and predictability. Alternatively, you may find that a more flexible option, such as a business line of credit, better suits your needs. With a business line of credit, you have the freedom to borrow and repay funds as needed, adapting to the changing demands of your business. This flexibility can be particularly advantageous during periods of fluctuating cash flow or when you require quick access to capital for unexpected expenses or opportunities. So, carefully evaluate your financial situation and business requirements to choose the loan type that best aligns with your long-term goals and cash flow management strategy.

6. Prepare Documentation

To ensure a smooth and efficient loan application process, it is important to gather all the necessary documentation for your chosen loan type. This may include business financial statements, such as balance sheets and income statements, tax returns to demonstrate your financial history, a well-structured business plan outlining your goals and strategies, and personal financial statements to provide a comprehensive overview of your personal financial situation. By being thoroughly prepared with these documents, you can expedite the application process and increase your chances of securing the loan you need.

7. Seek Professional Advice

When it comes to small business finance, it’s worth considering consulting with a knowledgeable financial advisor or accountant who specializes in this area. Their expertise can provide valuable insights and guidance that can help you navigate the complexities of business lending. By seeking their assistance, you can gain a deeper understanding of the financial landscape and make informed decisions that align with your business goals.

8. Apply Carefully

Once you’ve carefully and accurately completed the loan application for the chosen loan type and lender, it’s important to be prepared for the underwriting process. This process typically involves a comprehensive review of your financials and creditworthiness, ensuring that all necessary details are thoroughly examined to determine your eligibility. The underwriting stage plays a crucial role in assessing your ability to repay the loan and ensuring that the terms are aligned with your financial situation. Therefore, it’s essential to provide all required information and documentation promptly and accurately. By doing so, you increase the chances of a smooth and successful loan approval process.

9. Review Offers

When you receive loan offers, it is important to review them carefully and thoroughly. Take the time to pay close attention to details such as the interest rate, repayment terms, and any collateral or personal guarantees that may be required. It is also advisable to compare offers from multiple lenders if possible, as this will allow you to make a well-informed decision and choose the option that best suits your financial needs and goals. By being diligent and thorough in your evaluation of loan offers, you can ensure that you are making a wise and informed choice for your financial future.

10. Make Your Decision

After carefully evaluating all relevant factors, such as your business goals, financial situation, and repayment capacity, make a well-informed decision to choose the small business loan that aligns best with your unique needs. Once you have selected the ideal loan, proceed to sign the loan agreement, and leverage the acquired funds to drive growth and success for your business. This strategic approach will ensure that you make the most of your loan opportunity and maximize its potential benefits.

What is the Best Financing Option for a Business?

Selecting the ideal financing option for your business is a pivotal decision that can significantly influence its growth and success. With various financing avenues available, it’s essential to determine which one aligns best with your business goals and financial situation. Let’s explore the factors to consider when determining the best financing option for your business.

Evaluating Your Business’s Needs

Before diving into the world of business finance, take a step back and assess your business’s financial needs. Are you looking for funds to cover day-to-day operating expenses, embark on an expansion project, purchase equipment, or fuel a specific initiative? Understanding your financial requirements is the first step in pinpointing the most suitable financing option.

Weighing Your Creditworthiness

Your creditworthiness plays a substantial role in determining your eligibility for various financing options and the terms you’ll receive. Start by checking your personal and business credit scores and reviewing your credit history. The stronger your credit profile, the more financing options become available to you.

Exploring Different Lenders

The lending landscape is diverse, with options ranging from traditional banks and credit unions to online lenders and specialized financial institutions. Research and compare these lenders, keeping a keen eye on their loan products, interest rates, and terms. Look for lenders with a proven track record of serving businesses similar to yours.

Calculating the Total Cost

To make an informed decision, it’s crucial to calculate the total cost of borrowing for each financing option you’re considering. While interest rates are a significant factor, don’t overlook additional fees such as origination fees or annual maintenance fees. Understanding the overall cost will help you determine how it fits within your budget.

Examining Repayment Terms

The repayment terms associated with each financing option can significantly impact your business’s cash flow. For instance, term loans typically come with fixed monthly payments, making it easier to budget. On the other hand, business lines of credit offer flexibility with repayment schedules based on the amount borrowed. Consider which repayment structure aligns best with your financial needs and capacity.

Preparing Necessary Documentation

Different financing options may require varying levels of documentation. Be proactive in gathering the necessary paperwork, which may include business financial statements, tax returns, a well-thought-out business plan, and personal financial statements. Having these documents readily available can expedite the application process.

Seeking Professional Guidance

If navigating the intricacies of business finance feels overwhelming, consider seeking advice from a financial advisor or accountant with expertise in small business financing. They can provide valuable insights, guide you through the process, and help you make informed decisions.

Completing the Application

Once you’ve chosen a financing option and a lender, it’s time to complete the application carefully and accurately. Be prepared for the underwriting process, which may involve a detailed review of your financials, creditworthiness, and business plan.

Reviewing Offers

When you receive loan offers, scrutinize them closely. Pay particular attention to the interest rate, repayment terms, and any collateral or personal guarantees required. Comparing offers from multiple lenders, if possible, can help you identify the most favorable terms for your business.

Making the Final Decision

After thorough consideration, select the small business financing option that best aligns with your business goals, financial situation, and repayment ability. Once you’ve made your decision, sign the loan agreement and put the funds to good use for your business’s growth and success.

Conclusion

To recap, when comparing small business loan options, it’s crucial to consider the pros and cons based on your specific business needs. Keep in mind that the most suitable financing method may vary depending on factors such as creditworthiness and business nature.

By following the steps outlined and conducting thorough research, you can make an informed decision that propels your business towards success. We encourage you to engage with our brand and apply for a small business loan by clicking the link below.