Employers can qualify for up to $26,000 in tax credits per full time w2 employee and most don’t even know it-even if they got a PPP loan.They can use the money any way they want – and they don’t have to pay it back.

Most are confused and have not tried to get this credit – so we are happy to announce that a business owner can use our CPA partner services at NO UP FRONT COST.

Our CPA partners will work through the complex IRS code and determine eligibility and credit amount- again at NO UP FRONT COST.

It is a very confusing process for business owners – and most of their accountants can’t – or don’t want to put in the many hours of work simply to find out if they qualify or not.

However, many owners are eligible and are missing out on this FREE credit- and it can be sizeable – up to $26,000 per full time (30+hr/wk) w2 Employee. We want to help them!!!

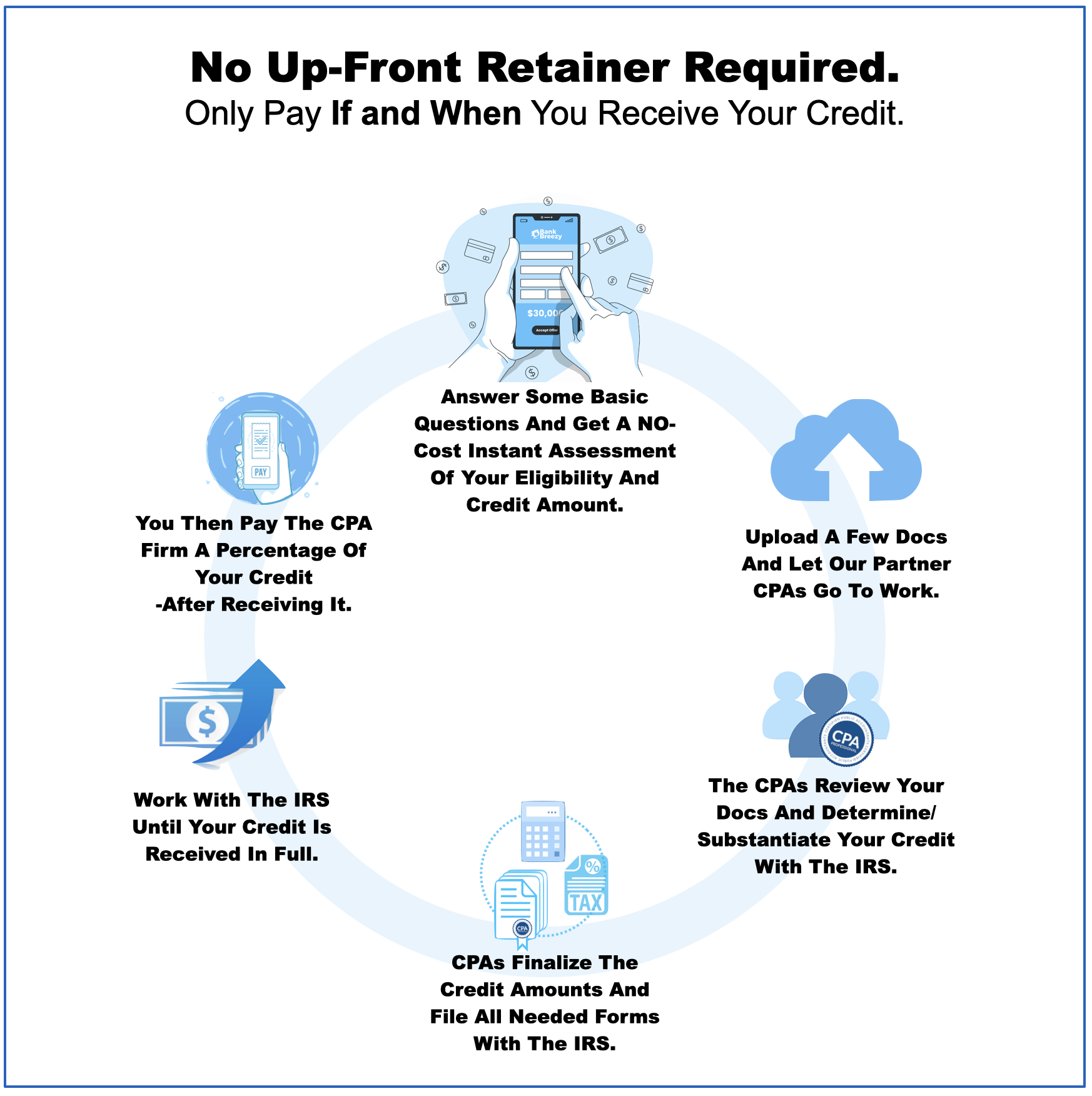

NO RETAINER NEEDED? Correct!

Most ERC Firms charge an up front “retainer” of $2,000-$4,000, plus 20-35% of the credit. NOT US!

We have partnered with an ERC Professional Service where their CPAs do not charge anything up front.

If you are not eligible for an IRS credit – you pay nothing.

If you are eligible, and do in fact receive a credit, only then do you pay a fee.

After getting the credit- you simply pay 20% of the credit that the CPAs find for you.